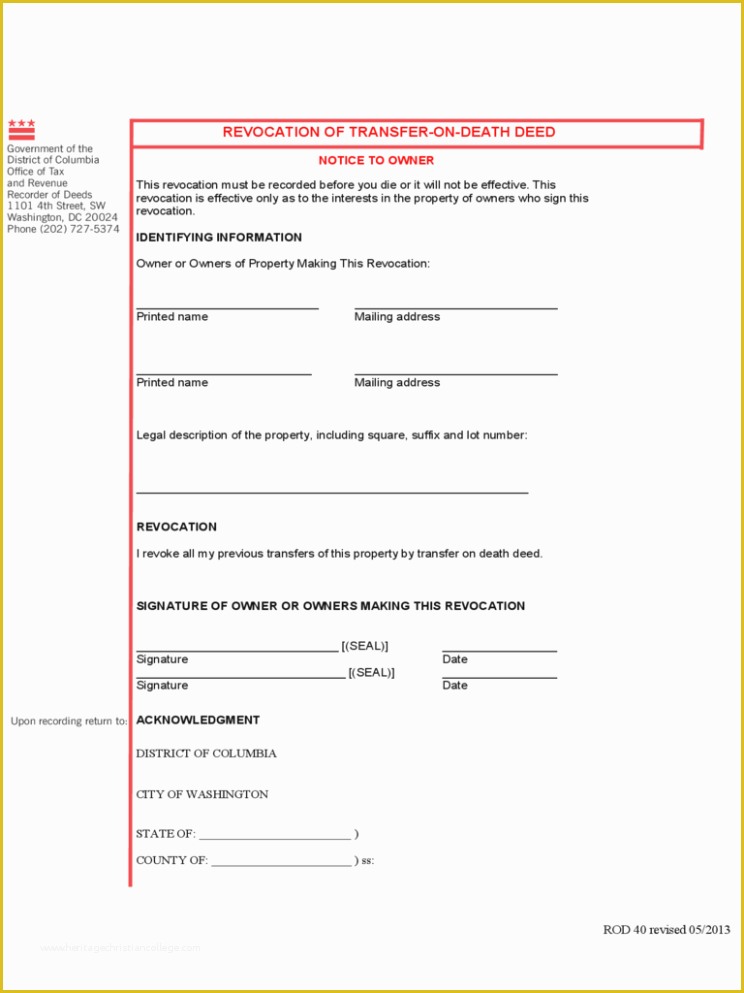

Restitution means that the transferor returns title to the real property and any net income (such as rents less expenses) that the beneficiary received since becoming the owner. The personal representative appointed by the court then has up to three years from the decedent’s date of death to demand restitution from any beneficiary of any TOD Deed executed by the decedent. Nonetheless, the creditors of the deceased transferor may themselves commence a probate in order to timely filing their own creditor claims within one year of the decedent’s death.

The foregoing $150,000 threshold excludes any non probate assets that pass without probate to designated death beneficiaries – e.g., life insurance, retirement accounts, and transfer on death financial accounts – or joint tenancy assets that pass without probate to surviving joint tenants. Transferors who use a TOD deed do so to avoid a probate: When they die the beneficiaries of their estate will rely on the TOD Deed to transfer title to the decedent’s residential real property and on the small estate affidavit procedure to obtain other assets assuming that the other assets in the decedent’s estate are collectively worth under $150,000. Thus, the beneficiary not only inherits the real property but also inherits personal liability to pay the decedent’s debts, even unsecured debts, like credit cards, even though unrelated to the real property. For a period of up to three years after the death of the transferor, the personal representative in the probate of the decedent’s estate may demand restitution from any of the beneficiaries to satisfy such debts. If deceased grantor has unpaid debts, the TOD Deed creates potential liability and risk for the surviving beneficiary if a probate is opened. Unfortunately, it poses numerous risks and drawbacks to the beneficiary upon the death of the grantor, as discussed below. April 20, 2015.The California Revocable Transfer on Death Deed (“TOD Deed”), effective January 1, 2016, is intended as an inexpensive alternative to the revocable living trust for persons of modest means to transfer their noncommercial, residential real property without probate. Notwithstanding the provisions of Section 26 of Title 16 of the Oklahoma Statutes, an affidavit properly sworn to before a notary shall be received for record and recorded by the county clerk without having been acknowledged and, when recorded, shall be effective as if it had been acknowledged.Īdded by Laws 2008, c. For a record owner's death occurring on or after November 1, 2011, the beneficiary shall record the affidavit and related documents with the office of the county clerk where the real estate is located within nine (9) months of the grantor's death, otherwise the interest in the property reverts to the deceased grantor's estate provided, however, for a record owner's death occurring before November 1, 2011, such recording of the affidavit and related documents by the beneficiary shall not be subject to the nine-month time limitation. The grantee shall attach a copy of the record owner's death certificate to the beneficiary affidavit. A legal description of the real estate.ĭ. Whether the record owner and the designated beneficiary were married at the time of the record owner's death andģ.

Dtransfer on death deed co benficiaries verification#

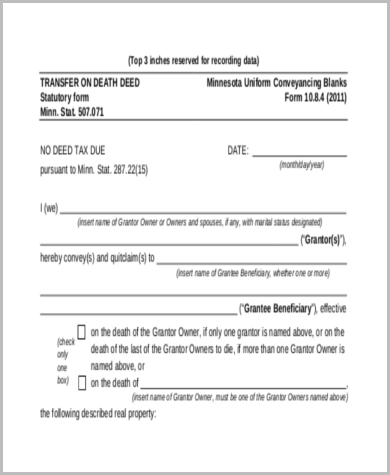

Verification of the record owner's death Ģ. To accept real estate pursuant to a transfer-on-death deed, a designated grantee beneficiary shall execute an affidavit affirming:ġ. The signature, consent or agreement of or notice to a grantee beneficiary or beneficiaries of a transfer-on-death deed shall not be required for any purpose during the lifetime of the record owner.Ĭ. For purposes of the Nontestamentary Transfer of Property Act, an "interest in real estate" means any estate or interest in, over or under land, including surface, minerals, structures and fixtures.ī. A transfer-on-death deed need not be supported by consideration. The deed shall transfer ownership of the interest upon the death of the owner. An interest in real estate may be titled in transfer-on-death form by recording a deed, signed by the record owner of the interest, designating a grantee beneficiary or beneficiaries of the interest.

0 kommentar(er)

0 kommentar(er)